Charitable Tax Harvesting

The next video is part two of advanced tax planning options as this topic covers how to use charitable deductions to minimize capital gains. Please feel free to watch the video or read the transcript.

The Government Confiscatory Tax System

We all know that we live in a confiscatory tax system. We make money from income capital gains, and we know that we get the keep a part of it and that we get to be mandatory donors to the IRS and franchise tax board charities.

We live in a philanthropic confiscatory tax system where depending on how much money you make, you may pay more or less, but a portion of whatever you’re doing will support the IRS.

What We Don’t Know

- 60% of our income tax is optional

- 100% of long-term capital gains tax can be optional

- 100% of estate tax is optional

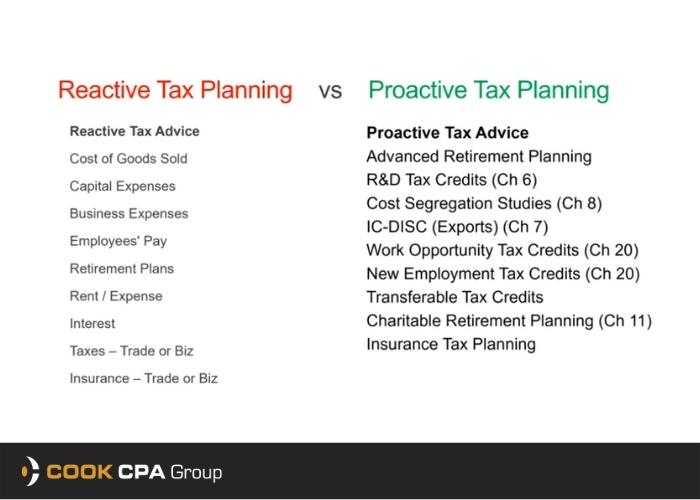

How Do You Pay Less Tax?

No tool makes it work for everybody and everything. But generally, the three main things that can help you pay less tax are insurance, business or trust, and a charity. Effective tax planning usually involves these three different things working together to create optimized opportunities.

Question: What is the maximum amount of money or assets a person can donate to a charity each year?

Answer: No Limit!

Maximum Charitable Adjusted Gross Income Deduction Rules

Schedule A, Line 11 – Cash= 60% (Can be 100% as of 2022 because of the Secure Act)

Schedule A, Line 12 – Appreciated Assets(Eg. Stocks and Real Estate) = 30%

If your adjusted income this year is $100,000, the most you can claim as a charitable deduction for cash under most circumstances usually is sixty percent or sixty thousand dollars.

If you give up to 60,000 to charity and claim it as a gift, you have reduced your adjusted gross income from 100,000 down to a 40,000 tax event. In doing so, you have probably not only reduced your taxable AGI, but you may have a lower tax rate. You can drop down one or two thresholds to get you into a more favorable income tax deduction

Example of using charity for people in 50% tax Bracket

If you have a $1,000,000 AGI, normally, you will be in a 50% tax bracket and have to pay 50% tax to the IRS. That means $500,000 goes to your tax, and you take home $500,000. But if you decide to gift $50,000 in cash to your IRS-approved charity, you can save $25,000.

This is how it works. Now that you gift $50,000 to a charity, you can include that in your Schedule A, Line 11. By doing so, you can get a $25,000 tax deduction. Your current AGI now becomes $950,000; you only have to pay $475,000 of your tax and used the $25,000 tax deduction.

Income and Captain Gains Tax Rescue Play

Now, let’s make this more interesting. What if five years ago, you had $40,000 burning a hole in your pocket. You went out to your financial planner to buy four positions for $10,000 a piece. That will be your basis, after-tax money.

Two of those positions did really well, and we call them racehorses. One of these positions started out pretty good, and then about two years down the road becomes flatlined. It grew to $50,000 in value, but for the last three years, it’s been doing nothing. Technically, you have lost an opportunity cost in this case. We call that one a donkey. The last position that you bought is hanging on for his dear life. It’s still worth $10,000, but you lost on opportunity cost.

What if you gave the $50,000 donkey to a charity? If you tried to sell the $50,000 stock and gain $40,000, you’re going to pay tax. Well, let’s think a little bit differently. So if you give the $50,000 as a block of stock that has a basis of $10,000 to a charity, technically, the charity’s going to turn it around and sell it. The charity has the same net effect.

If your charity doesn’t have a brokerage account, tell them to open up one. They’re not making it easy for donors to donate by not having one. So you better ask them to have one.

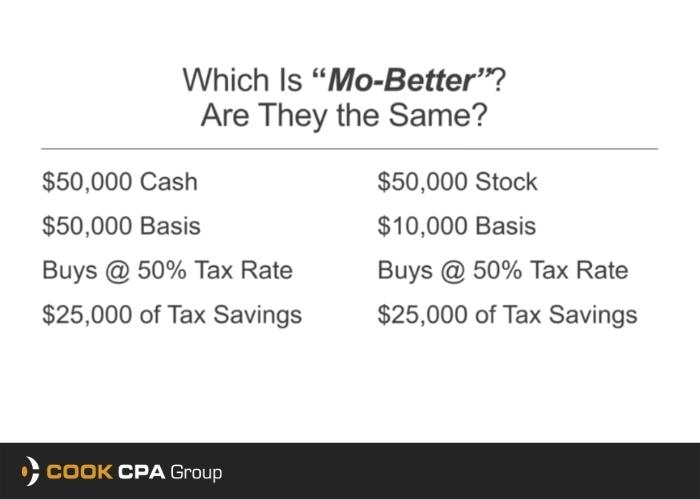

So you tell your financial planner to give the $50,000 value of the stock to the charity. The Charity converted that stock into cash. You get rid of the donkeys that are going to cost you money if you sell them, and you get $15,000 of money off the IRS. You may be confused, but let’s check out the image below.

On the left side, it shows you gave $50,000 of cash and bought you $25,000 off the tax statement. On the right side, you gave a charity $50,000 of stock that had a basis of $10,000. Now you’re in a 50% tax bracket on the tax form.

On the tax form, it’s the same. It’s the same deduction on the tax form except for one thing. Notice the basis here. In this case, $10,000 of basis bought you $25,000 of tax savings. Now, that’s $15,000 money you made off the IRS.

Conclusion

Overall, first, determine if you have highly appreciated poorly performing assets. You may want to consider making money off the IRS while still accomplishing your philanthropic objective.

At an early age, most of us were taught just to give cash to charity, and that’s all we’ve ever been doing. If you like making money off the IRS and still want to help your chosen charity, you may want to look at this concept.