Helpful Articles

Article Category Selector

- All

- Audits

- Business Advice

- Business Taxes

- Credits

- Deductions

- Depreciation

- Estate Planning

- Incentives

- News

- Regulations

- Taxes

- Videos

All

- All

- Audits

- Business Advice

- Business Taxes

- Credits

- Deductions

- Depreciation

- Estate Planning

- Incentives

- News

- Regulations

- Taxes

- Videos

Tax Extension Deadline 2025: What Smart Taxpayers Do After Filing

June 12, 2025

Business Taxes Taxes

Tax Extension Tips: Filing a Tax Extension Is Step One. Here’s What Smart Taxpayers Do Next. If you filed a tax extension in 2025—whether for ...

Read More →

Bookkeeping: Essential Tips for Small Business Success

February 24, 2025

Business Advice

Bookkeeping is the recording of all financial transactions, essential for small businesses to track income, manage expenses, and comply with regulations. Without good bookkeeping, businesses ...

Read More →

Estimated Tax Payments for 2025

February 24, 2025

Taxes

Federal Estimated Tax Payment Rules for 2025 If you expect to owe at least $1,000 in federal taxes after subtracting withholding and refundable credits, you’re ...

Read More →

FAQ: What Items Do I Need to Provide for Tax Preparation?

February 24, 2025

Taxes

Providing all necessary documents upfront helps us complete your tax return accurately and efficiently. Here’s a detailed list of items to gather and submit: 1. ...

Read More →

Frequently Asked Questions on Taxes for Business Owners for 2025

February 24, 2025

Business Taxes

Tax Deadlines When are the 2024 tax deadlines? S-Corporations and Partnerships: March 17, 2025 (since March 15 is a Saturday) C-Corporations: April 15, 2025 Estimated ...

Read More →

Understanding the Audit Financial Statement Process: A Comprehensive Guide

February 15, 2024

Audits Business Advice

What compels businesses to conduct an ‘audit financial statement’, and how does it safeguard financial veracity? This article breaks down the process – from rigorous ...

Read More →

Mastering Accounting in Construction: A Practical Guide for Efficient Financial Management

February 14, 2024

Business Advice Business Taxes

In the construction industry, where every project serves as a distinct financial entity with its own set of complexities, mastery over accounting in construction is ...

Read More →

Optimizing Your Practice: Top Strategies for Accounting for Veterinarians

February 13, 2024

Business Advice Business Taxes

Are you navigating the complex financial landscape of your veterinary practice and wondering how to enhance its profitability and stability? Effective accounting for veterinarians goes ...

Read More →

Minimizing Tax Season Stress (6 Effective Tips That Work)

February 5, 2024

Business Advice Business Taxes

Arf! Arf! It’s me, Breyer, the office curator. This is the next installment of my Cook CPA blog, and I am still giving the best ...

Read More →

All you ever wanted to know about estate plans

November 11, 2023

Estate Planning

Do you want to ensure your loved ones are taken care of and your hard-earned assets are managed according to your wishes? An estate plan ...

Read More →

Write Off These Home Improvements to Save Money This Tax Season

August 16, 2023

Business Advice Business Taxes

With economic uncertainty looming over many American households, you may be wondering if there are home improvement deductions you can take advantage of to save ...

Read More →

How Having An LLC Can Help You Avoid Paying Too Much Tax

August 16, 2023

Business Advice Business Taxes

Choosing the right business entity for your company can have a huge impact on how you pay business income tax. Many businesses elect to set ...

Read More →

4 Reasons Why Outsourcing a CFO Saves You Money In Business

August 16, 2023

Business Advice Business Taxes

Outsourcing the CFO role can be a huge money saver for your business. The CFO is one of the most critical roles you can hire ...

Read More →

The Right Way to File Your Business and Personal Taxes

February 28, 2023

Business Taxes

Filing your business and personal taxes can be daunting, but it’s an important part of being a responsible business owner and citizen. By following the ...

Read More →

What Size Company Needs a CFO?

February 21, 2023

Business Advice

Hiring a Chief Financial Officer (CFO) is an important decision for any business. But you may be wondering what size company needs a CFO. Considering ...

Read More →

How to Make Tax-Free Gifts in 2023

February 14, 2023

Deductions

The IRS allows individuals to make tax-free gifts to certain recipients under specific circumstances. While you may not believe you are in the financial position ...

Read More →

7 Tax Tips for 2023 to Save Your Family Money

February 7, 2023

Deductions

The new year is just around the corner, and it’s time to start thinking about taxes and saving your family money. Tax season can be ...

Read More →

Frequently Asked Questions About Filing Business Taxes For the First Time

January 31, 2023

Business Taxes

Starting a business is an exciting time in any entrepreneur’s life. However, the elation you may feel in seeing your vision come to life can ...

Read More →

6 Medical Expenses You Didn’t Know Were Deductible

January 24, 2023

Deductions

With the cost of US healthcare sharply rising, you may wonder if you can deduct medical expenses to save money on your taxes this year. ...

Read More →

5 Signs It’s Time to Hire an Outsourced CFO

January 17, 2023

Business Advice

As a business owner, finding time to get your finances in order while keeping up with the demands of daily operations quickly becomes impossible. Between ...

Read More →

4 Question You Must Ask Yourself Before Doing Own Business Accounting

December 6, 2022

Business Advice Business Taxes

Ensuring your business operations run smoothly is an overwhelming responsibility as a business owner. While some processes can come more easily to you than others, ...

Read More →

5 Child and Dependent Expenses You Can Deduct From Your Taxes This Year

November 29, 2022

Business Taxes Deductions

The rising cost of living is a significant burden for many U.S. families. While you can’t deduct grocery bills or utilities from your tax bill, ...

Read More →

Tricks Your CFO Should Be Using To Be More Effective

November 22, 2022

Business Advice

Hiring a CFO is an essential step in ensuring your company’s financial health. However, many CFOs get so bogged down with competing priorities that they ...

Read More →

Your Checklist for Paying Taxes Your First Year In Business

November 15, 2022

Business Advice Business Taxes

Reaching the end of your first year in business is a significant milestone. Bringing your idea to life and achieving your business goals is no ...

Read More →

4 Ways to Simplify Your Business Finance Process

November 8, 2022

Business Advice

Today’s businesses require financial management processes and systems that are agile, efficient, and digital. As both small business and accounting professionals, we have the privilege ...

Read More →

5 Ways Outsourced CFO Services Can Help Your Sacramento Business

November 2, 2022

Business Advice

A chief financial officer (CFO) is crucial to the success of your business, but hiring someone to take on the job can feel daunting. You ...

Read More →

5 Ways You May Be Exposing Yourself to a Tax Audit

October 25, 2022

Audits Business Taxes

Tax season is an incredibly stressful time of year. Most of us try our best to keep accurate records of all our finances for smoother ...

Read More →

6 Red Flags You May Be Missing In Your Business Financial Statements

October 18, 2022

Business Advice

Understanding your business’s balance sheet or cash flow statements is essential to operating your business. But staying on top of your business financial statements while ...

Read More →

Tax-Saving Tips for Your College-Bound Kids

October 11, 2022

Business Taxes Deductions

With colleges across the country opening their campuses for a fresh new set of students, it’s the perfect time to consider the tax savings ...

Read More →

How to Account for Independent Contractors in Your Business Taxes (4 Questions You May Be Asking)

October 4, 2022

Business Taxes

With nearly 60 million Americans identifying as independent contractors, it’s important to understand how your business should account for these types of workers come tax ...

Read More →

5 Strategic Accounting Tips for Mid-Sized Businesses

September 27, 2022

Business Advice

As a mid-sized business, you know how difficult it can be to stay on top of your accounting. With employees to manage, fires to put ...

Read More →

9 Lesser Known Tax Write-Offs for LLCs and S-Corps

September 20, 2022

Business Advice Business Taxes

As the owner of an LLC or S-Corp, paying less money in taxes means you have more to spend on building your business to new ...

Read More →

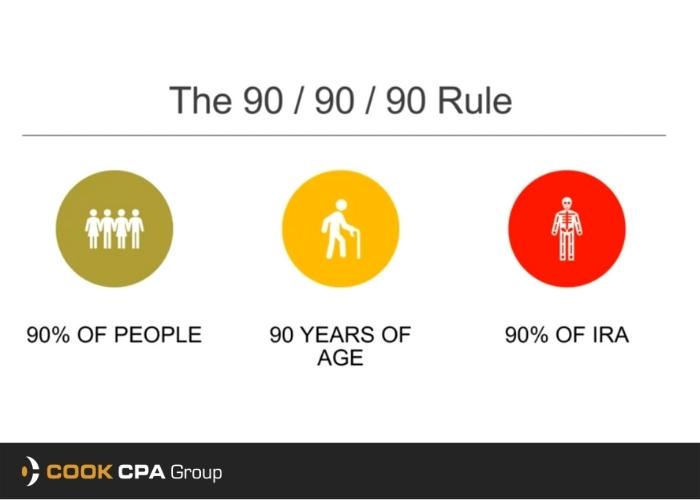

90 90 90 Rule

July 26, 2022

Business Taxes Deductions

This is the final series with Ed Cotney as he concludes with an in-depth discussion of the IRA rules to consider other approaches to address ...

Read More →

Charitable Tax Harvesting

July 19, 2022

Business Advice Business Taxes

The next video is part two of advanced tax planning options as this topic covers how to use charitable deductions to minimize capital gains. Please ...

Read More →

Charitable Trust Tax Planning

June 15, 2022

Business Taxes Deductions

This is part one of a video series discussing various advanced tax planning concepts. The majority of this discussion covers charitable remainder trusts. Feel feel ...

Read More →

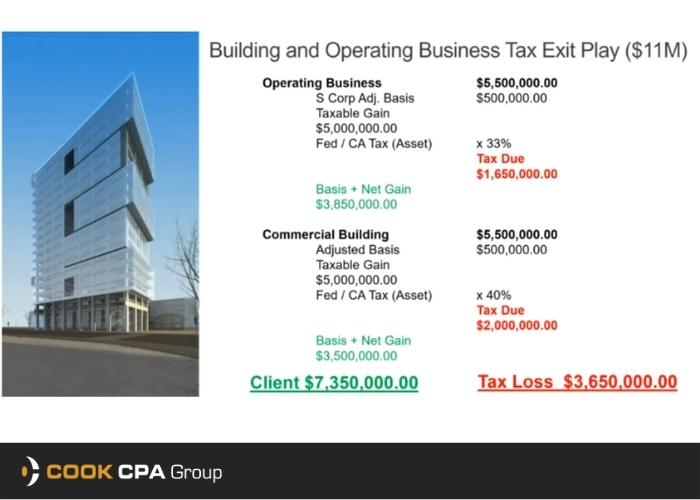

A Tax Strategy You May Be Missing

June 11, 2022

Business Advice Business Taxes

One of my joys in April (just before tax season is over) is getting the iPad all cleaned up and updating the app to watch ...

Read More →

How To Get Your Business Back On Track: An Actionable Guide

March 7, 2022

Business Advice

Arf! Arf! It’s me, Breyer, the office curator. This is the next installment of my Cook CPA blog, and I am still giving the best ...

Read More →

Common Things to Consider When Starting a Business

January 14, 2022

Business Advice

Arf! Arf! It’s me, Breyer, the office curator. I’m back at Cook CPA, writing my blog to give the best advice a dog can. ...

Read More →

Building A Vertically Integrated Wine Business

February 22, 2021

Business Advice Videos

From growing grapes to selling wine, building a vertically integrated wine business with Peltier winery and vineyards. Learn how Peltier winery and vineyards grew their ...

Read More →

How Do You Calculate Depreciation on Business Equipment?

February 17, 2021

Depreciation

Our qualified tax accountants can help you with the complex process of calculating business equipment depreciation. Contact us today to learn how to calculate depreciation ...

Read More →

What Are Qualified Research & Development Expenses in CA?

February 17, 2021

Deductions

Tax credits from the can help you to recover expenses for research and development in CA. Learn more from our certified tax professionals about qualified ...

Read More →

Who is Eligible for the FICA Tip Credit in California?

February 17, 2021

Credits

Who is eligible for the FICA Tip Credit in California? Understanding and utilizing the federal FICA Tip Credit can save your business thousands of dollars ...

Read More →

What Are the Standard Tax Deductions in California for 2021?

February 17, 2021

Deductions

Identify the standard tax deductions in California for 2021. With Tax Day coming up, the California tax preparers of Cook CPA Group discuss the standard ...

Read More →

Does California Have a Late Tax Filing Deadline in 2021?

February 16, 2021

Regulations

Does California Have a late tax filing deadline in 2021? Sacramento CPAs discuss time extensions to file a state tax return in CA. For help ...

Read More →

What is the 2021 Tax Filing Deadline for U.S. Citizens Abroad?

February 16, 2021

Regulations

What is the 2021 tax filing deadline for US citizens abroad? Sacramento CPAs explain the deadline to file a US income tax return for citizens ...

Read More →

What Business Expenses Must be Depreciated in CA?

January 7, 2021

Business Taxes Depreciation

What business expenses must be depreciated in CA? If you need help determining which business expenses are depreciable, our experienced California accountants can help Contact ...

Read More →

Tax Incentives that are Available to Wineries in California

December 17, 2020

Business Taxes Incentives

Our CPAs can help you find any Tax incentives that are available to wineries in California to save you time and money so you can ...

Read More →

Tax Incentives that are Available to Distilleries in California

December 17, 2020

Business Taxes Incentives

Our accountants can help you find all tax incentives that are available to distilleries in California so you can save money and focus on running ...

Read More →

Navigating the People Side of Running a Successful Distillery

December 14, 2020

Business Advice Videos

Navigating the people side of running a successful distillery can be challenging. Learn how the Loch & Union distillery has handled the personnel, partnerships, and ...

Read More →

The Types of Financial Statement Audits in California

November 23, 2020

Audits

Companies often prefer to have financial statements checked for accuracy before sending them to another party. Learn the different types of Statement Audits in CA.

Read More →