Charitable Trust Tax Planning

This is part one of a video series discussing various advanced tax planning concepts. The majority of this discussion covers charitable remainder trusts. Feel feel to watch the video or read the transcript.

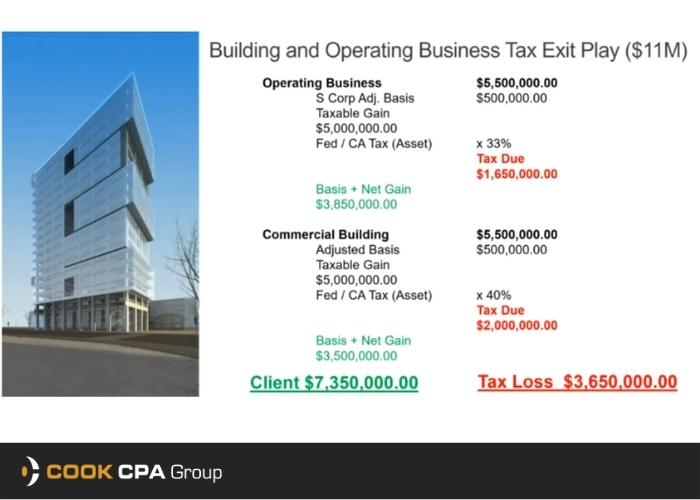

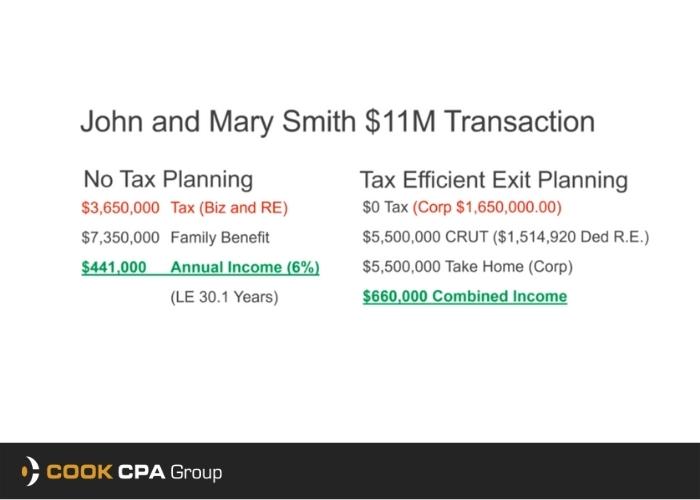

John And Mary Smith likes to sell their 11 million dollar business. The total value of the assets (Business and Commercial Building) is around 11 Million Dollars. If they do nothing, their tax with the business will cost them around $1,650,000.000 and $2,000,000 for the commercial building. They go home with 7.35 Million, and the IRS goes home with 3.65 Million.

Using Charitable Trust

A charitable trust is an irrevocable trust. A charitable trust is a tool that has two jobs. One, to give you an income stream normally for life, and when you and your spouse die, whatever is left in that trust goes to the charitable structures you like. This could be Red Cross, Salvation Army, or whatever charity comes to mind.

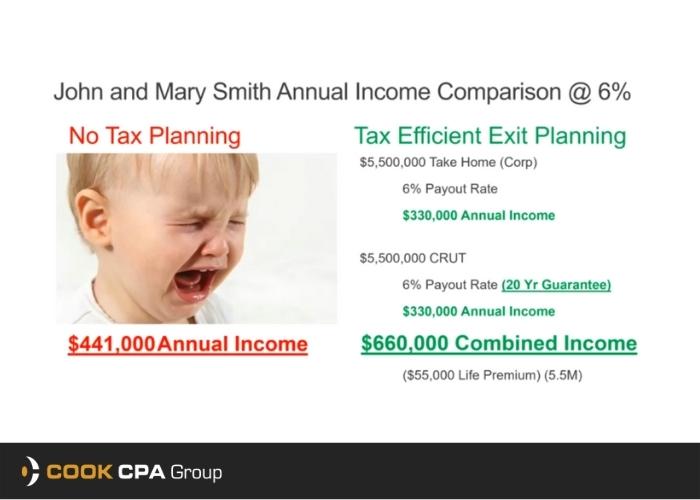

We put the building in this charitable trust. This charitable trust is a tax-exempt irrevocable trust. By doing this, we bypass all the capital gains and recapture tax. So, in this case, if they put a 5.5 million dollar highly appreciated building into a charitable trust, there’s no tax. Another benefit is that the IRS is going to give them a charitable income tax deduction, in this case, 1.65 Million Dollars.

So if they sell the business and donate that building into the charitable trust, they’re almost going to be zero tax. It may take them a couple of years as far as tax returns to enjoy all these benefits, but it boils down to higher annual income.

Now you may say, that their kids aren’t getting the value of that building when they die. Then, let’s just use some money to buy a life insurance policy to replace that value. In effect, the IRS just paid for the life insurance policy.

This strategy is not new. It’s just new to some people or even you. So when you hear people talking about charitable tax planning, those are the people who have figured out that there’s a way that we can do more good for everybody involved and put a lot of money in the hands of a charitable organization.

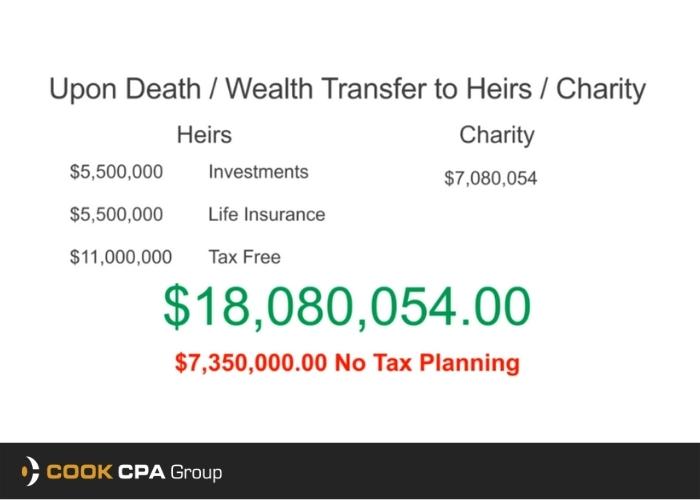

We’ve done several strategies now on the death of John and Mary. We’ve done seven million dollars going to charity. We replace the value going to the charity using life insurance. The life insurance all goes tax-free, assuming the law doesn’t change in respect to step up in basis rules. We’ve increased the income to 159,000 a year for the rest of their life.