Do you want to ensure your loved ones are taken care of and your hard-earned assets are managed according to your wishes? An estate plan is the answer, but where do you start? This comprehensive guide will walk you through the essential aspects of estate planning, from understanding the process to creating crucial documents, and how to avoid common pitfalls. Let’s secure your legacy and protect your family’s future together!

Short Summary

- Estate planning is essential to ensure your wishes are honored and assets protected.

- Create an estate plan with experienced professionals to secure a future for loved ones & minimize taxes.

- Invest in estate planning now for financial stability & peace of mind later!

Understanding Estate Planning

Estate planning is a vital process that helps secure your assets and guarantees they are distributed according to your wishes after death or incapacity. But estate planning is more than just creating a will; it encompasses a wide range of aspects, including appointing executors or trustees, creating essential documents, and understanding tax laws. By working with experienced estate planning attorneys, you can ensure all aspects of your plan are properly addressed and avoid common estate planning mistakes.

To embark on this journey, we will dive into the estate planning basics and the estate planning process, along with its goals. By understanding these fundamentals, you can confidently create a valid estate plan that aligns with your wishes and secures the future for your loved ones.

Estate Planning Process

The estate planning process begins with a comprehensive review of your assets, including bank accounts, real estate, and other real and personal property. To ensure all assets are accounted for, consider creating a detailed inventory, which will serve as the foundation of your estate plan.

Next, think about the well-being of any minor children and appoint a guardian to care for them in the event of your death. This step ensures your children are taken care of by someone you trust.

Once you have a clear picture of your assets and your loved ones’ needs, it’s time to create the essential estate planning documents, such as wills, trusts, powers of attorney, and advance healthcare directives. Adequate estate planning, guided by an experienced estate planning attorney, can ensure these documents are tailored to your unique situation and in compliance with all legal requirements.

Goals of Estate Planning

Estate planning serves several essential goals, such as providing for your loved ones, minimizing taxes, protecting your assets, and maintaining privacy. By designating beneficiaries in your will or trust and providing for the care of minor or disabled family members, you can ensure your loved ones are taken care of. Additionally, estate planning can help minimize taxes by taking advantage of tax deductions, credits, and exemptions.

Another critical aspect of estate planning is managing your assets during life and after death. By setting up a will or trust, appointing an executor or trustee, and establishing powers of attorney, you can ensure your assets are managed according to your wishes and your loved ones are supported during difficult times. Working closely with estate planning attorneys can provide invaluable guidance in achieving these goals effectively.

Essential Estate Planning Documents

Estate planning documents, which are a type of legal document, are the building blocks of a successful plan, providing a roadmap for your wishes and protecting your loved ones. These essential documents include wills, trusts, powers of attorney, and advance healthcare directives. Each document serves a unique purpose, addressing various situations and ensuring your assets are managed and distributed according to your wishes. It’s important to consider other estate planning documents that may be relevant to your specific needs.

Let’s delve deeper into the roles and benefits of these essential estate planning documents, including wills and trusts, powers of attorney, and advance healthcare directives. By understanding their significance, you can create a comprehensive estate plan that covers all your bases.

Wills and Trusts

Wills and trusts are legal documents that outline how your assets will be distributed and managed after your death. A will ensures your wishes are respected and appoints a guardian for minor children, while a trust offers additional benefits, such as avoiding probate and protecting assets for beneficiaries who are not yet ready to manage them.

Establishing a trust can save time and money for your loved ones, as property within the trust does not have to go through probate court. Trusts are also useful for holding property when beneficiaries are minor children or when you want to distribute assets faster and more efficiently.

By understanding the advantages of wills and trusts, you can make informed decisions about which estate planning tools best suit your needs.

Powers of Attorney

Powers of attorney are legal documents that grant authority to an agent to make financial and healthcare decisions on your behalf in case of incapacity. There are various types of powers of attorney, including durable, limited, and financial, each serving a unique purpose in managing your legal and financial affairs. By designating a trusted individual as your agent, you ensure that your financial and healthcare decisions are made according to your wishes.

A health care proxy, also known as a medical power of attorney, is a specific type of power of attorney that allows your agent to make medical treatment decisions on your behalf. This document is particularly crucial in situations where you are unable to communicate your medical preferences. By establishing powers of attorney, you gain peace of mind knowing that your financial and healthcare matters will be handled by someone you trust.

Advance Healthcare Directives

Advance healthcare directives combine living wills and medical powers of attorney to specify your medical preferences and designate decision-makers in case of incapacity. A living will outlines your medical wishes, while a medical power of attorney allows you to appoint someone to make healthcare decisions for you if you are unable to do so.

An advance healthcare directive provides the opportunity to not only give instructions for your care, but also designate someone else to make decisions for you if needed. By creating an advance healthcare directive, you can ensure that your wishes for end-of-life care are respected and that your designated decision-maker is aware of your preferences.

Role of Executors and Trustees

Executors and trustees play crucial roles in managing and distributing assets according to your wishes. Executors are responsible for handling wills and distributing assets, while trustees manage all assets or property within a trust. These individuals are entrusted with the critical responsibility of ensuring that your estate is managed and distributed according to your desires.

Choosing the right executor and understanding the duties and responsibilities of trustees are essential aspects of estate planning. By selecting trustworthy individuals and providing them with clear guidance, you can ensure that your assets are managed effectively and your wishes are honored.

Choosing the Right Executor

Choosing the right executor involves considering factors such as trustworthiness, financial knowledge, and willingness to take on the responsibility. Family members, friends, or professional executors such as lawyers or accountants can all help you manage your estate effectively. However, it is essential to have a thorough discussion with potential executors, assess their qualifications, and confirm that they are eager and capable of taking on the responsibility.

By selecting an executor who understands your wishes and has the necessary skills to manage your estate, you can ensure that your assets are distributed according to your desires and that any potential legal issues are addressed promptly.

Trustee Duties and Responsibilities

Trustee duties include managing trust assets, distributing them according to the trust terms, and maintaining records and communication with beneficiaries. As a trustee, you have the opportunity to make a lasting impact by ensuring that assets are managed efficiently and distributed in line with the grantor’s wishes.

By understanding the duties and responsibilities of trustees, you can ensure that your trust is managed effectively and that your beneficiaries receive the support they need. This knowledge is crucial for protecting your legacy and providing for your loved ones after your passing.

Tax Considerations in Estate Planning

Tax considerations play a significant role in estate planning and can impact the distribution of your assets to your beneficiaries. By understanding the federal estate tax threshold, state inheritance taxes, and tax reduction strategies, you can minimize your tax liability and preserve your assets for your loved ones.

Let’s explore these tax considerations in detail, including the federal estate tax threshold, state inheritance taxes, and various strategies to reduce your tax burden. By gaining a comprehensive understanding of these tax implications, you can plan your estate more effectively and ensure that your loved ones receive the maximum benefits.

Federal Estate Tax Threshold

The federal estate tax threshold is an impressive $12.92 million, which determines whether your estate is subject to federal estate taxes. Most estates fall below this threshold, meaning they do not owe any federal estate taxes. By understanding the federal estate tax threshold, you can plan your estate more effectively and minimize your tax liability.

To ensure you are taking full advantage of the federal estate tax threshold, consider consulting with an estate attorney, tax advisor, or financial planner for legal or tax advice. These professionals can help you navigate the complexities of tax laws and maximize the benefits for your estate and your beneficiaries.

State Inheritance Taxes

State estate and inheritance taxes vary by state and can have a significant impact on your estate planning. These taxes are separate from the federal estate tax and may apply to the transfer of assets from a deceased person to their beneficiaries. Some states have both an estate tax and an inheritance tax, while others have one or the other, with rates and exemptions differing among states.

To gain insight into potential tax liabilities related to state inheritance taxes, consult with an estate planning professional. They can help you understand the specific tax laws in your state and ensure your estate plan is tailored to minimize your tax liability and protect your assets.

Tax Reduction Strategies

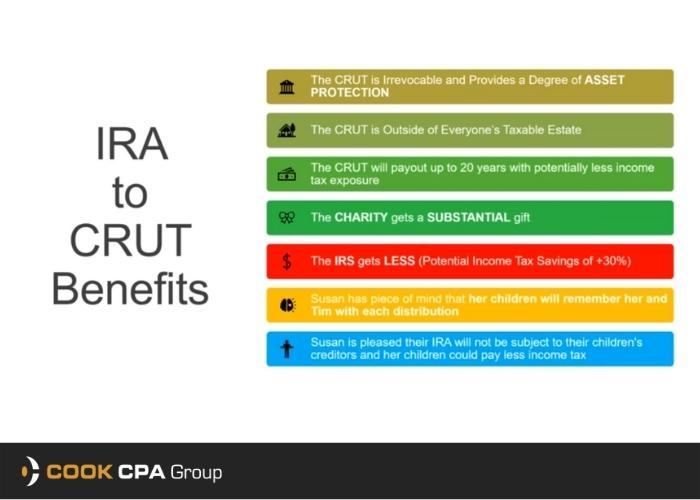

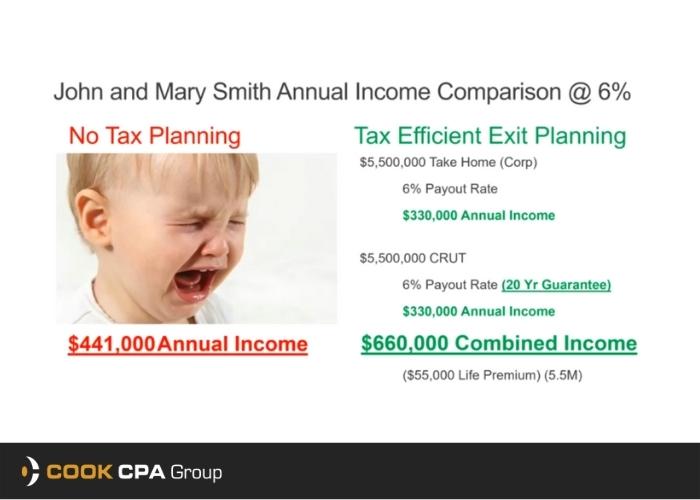

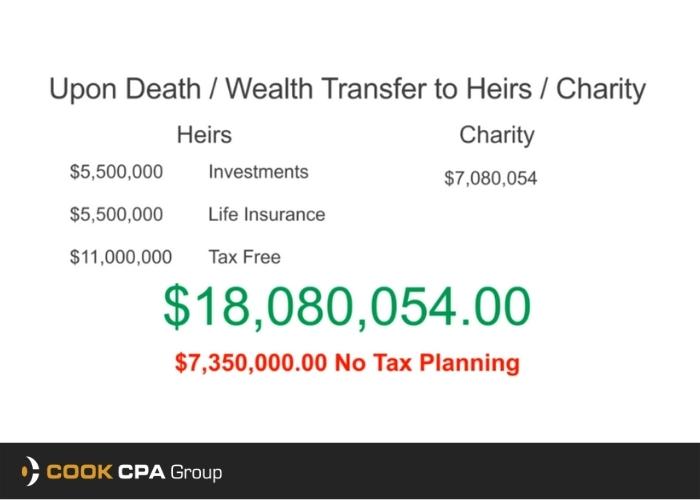

Tax reduction strategies in estate planning can help you minimize your tax liability and maximize the assets you leave for your beneficiaries. These strategies include charitable giving, education funding, and estate freezing, which can provide tax deductions and protect your assets from unnecessary taxes.

Charitable giving allows you to donate money or assets to a charitable organization, reducing your taxable estate and providing tax deductions. Education funding sets aside money for a beneficiary’s education, potentially reducing your taxable estate and providing additional tax deductions. Estate freezing is a powerful strategy that transfers assets to a trust or other estate planning vehicle, reducing your taxable estate and providing tax deductions.

By employing these tax reduction strategies, you can preserve more of your assets for your loved ones.

Life Insurance and Estate Planning

Life insurance can play a significant role in estate planning by providing funds for your beneficiaries, covering estate taxes and expenses, and funding business agreements or retirement plans. A properly structured life insurance policy can help ensure your loved ones are financially secure and your estate is managed effectively.

By incorporating life insurance into your estate plan, you can provide a financial safety net for your family and protect your assets from unnecessary taxes and expenses. Consult with an experienced estate planning attorney or financial planner to determine the best life insurance policy for your unique needs and goals.

Common Estate Planning Mistakes to Avoid

Estate planning is a complex process, and it’s easy to make mistakes that can have serious consequences for your loved ones and your assets. Some common estate planning mistakes to avoid include not having a plan, failing to update documents, improper asset ownership, and underestimating tax implications.

By being mindful of these common mistakes and taking the necessary steps to avoid them, you can ensure that your estate plan is comprehensive, up-to-date, and in line with your wishes. Working with experienced estate planning attorneys can help you navigate the complexities of estate planning and avoid costly mistakes that could impact your loved ones.

The Cost of Estate Planning

The cost of estate planning varies depending on the complexity of your estate, the chosen method, and professional fees. Options range from affordable online services to hiring experienced attorneys to guide you through the process. On average, costs may range from $1,000 to $3,000, with additional fees for creating trusts or other documents.

While the cost of estate planning may seem daunting, it is a worthwhile investment in your family’s future. By ensuring your assets are managed and distributed according to your wishes, you can provide financial stability for your loved ones and protect your legacy for generations to come.

Digital Assets in Estate Planning

In today’s digital age, it’s essential to consider digital assets in your estate planning. Digital assets include online accounts, passwords, and digital files like images, videos, and documents. To ensure your digital assets are managed effectively, it’s crucial to list these assets and grant access to a trusted individual who can manage them in the event of your death or incapacity.

By incorporating digital assets into your estate plan, you can ensure that these valuable assets are protected and managed according to your wishes. This comprehensive approach to estate planning can provide peace of mind and security for your family’s digital future.

Estate Planning for Different Life Stages

Estate planning should be tailored to different life stages to ensure proper asset management and distribution throughout your life. Young families should consider designating guardians for minor children and establishing trusts for their care. Middle-aged individuals may need to update beneficiary designations on existing accounts and establish powers of attorney. Retirees should review and update their estate plan periodically and consider establishing healthcare directives.

By adapting your estate plan to suit your unique circumstances at each stage of life, you can ensure that your assets are protected and your wishes are respected, providing peace of mind and security for your loved ones.

Summary

In conclusion, estate planning is an essential process that allows you to secure your assets, provide for your loved ones, and ensure your wishes are respected. By understanding the estate planning process, creating essential documents, and avoiding common pitfalls, you can create a comprehensive and effective estate plan that protects your family’s future. Embrace the journey of estate planning and leave a lasting legacy for the ones you love.

Frequently Asked Questions

How does an estate plan differ from a will?

An estate plan is a collection of legal documents which often include a will, trusts, an advance directive and various types of powers of attorney. It goes beyond what a will can do and can cover other estate planning matters.

What are three elements of an estate plan?

Creating an effective estate plan requires having a Last Will & Testament, Durable Power of Attorney, and an Advance Health Care Directive. These three documents ensure that your wishes are followed should something happen to you.

Having these documents in place is essential for protecting your assets and ensuring that your wishes are respected. They provide a clear plan for how your estate should be handled and who should be responsible for carrying out your wishes.

What is the purpose of making an estate plan?

Estate planning is an important process to protect your assets and plan for their distribution after you die. It can also help minimize income, gift and estate taxes, and ensure that your wishes are followed regarding the management of your property and financial obligations in the event of incapacity.

What is another word for estate planning?

Legacy planning is a synonym of estate planning, gaining popularity among financial advisors in recent years.

What are the 7 steps in the estate planning process?

Start your estate planning process with these 7 simple steps – gather your financial information, meet with a lawyer, review your beneficiaries, choose an executor, create a will, draft a living trust, and consider incapacity planning.

It’s never too early to begin this important task!