Ensuring your business operations run smoothly is an overwhelming responsibility as a business owner. While some processes can come more easily to you than others, accounting practices are often weak points in many businesses.

You may think doing your own business accounting will save you much-needed cash flow, but if you don’t have a clear understanding of accounting practices, you could waste precious time and energy doing your own accounting.

Business accounting is one of the most important aspects of running a successful business. Before deciding to do your own business accounting, you should ask yourself the following four questions. These questions may help shape your perspective on some more technical aspects of business accounting.

In the end, you may find hiring an expert CPA saves you time, money, and energy.

How many monthly transactions do you expect?

An essential question to ask yourself before doing your own business accounting is how many transactions you expect to make each month. Keeping track of monthly transactions may be easy if you’re in the early stages of establishing your business. However, as your business grows, it becomes more important to ensure you track every transaction accurately.

There are many options to consider in the world of accounting software, with QuickBooks being a common choice among small business owners. Before you begin researching all your accounting software options, keep the following considerations in mind:

- Accounting software typically comes with a monthly or annual cost. Run the numbers to determine whether it may be more cost-effective to work with a CPA instead.

- Setting up your accounting software profile takes time. Consider the amount of free time you have to set up your account and learn the ins and outs of an accounting software program.

- Accounting software can have many features that go unused by your business. While offering shiny bells and whistles is a great way to attract new buyers, the truth is you may be paying for features you don’t need.

Can someone else validate your calculations?

Ensuring your financials are accurate is vital to the health of your business. Before deciding to do your own business accounting, ask yourself whether you feel confident making all the calculations yourself.

While accounting software can help you, it’s critical to manually review your calculations before filing your taxes. Many Cook CPA Group clients use their own accounting software but send us their account reports to ensure everything is up to snuff before filing their taxes.

Everyone makes mistakes, and it’s essential to recognize that business accounting is complex. Having a second pair of eyes to validate your calculations and confirm your accounts are in order is a huge step in ensuring you file your taxes accurately and timely. Doing your own business accounting may not be a wise decision for you if you don’t have someone you trust to double-check your financials.

Do you have separate business and personal accounts?

Maintaining separate business and personal accounts can go a long way in ensuring your accounting process is seamless. And, if your goal is to make paying taxes as easy as possible, separating your business accounting function from your personal accounts is critical.

Before deciding to do your own business accounting, review your current process. If you currently mix your business accounting with your personal accounting, it may be wise to separate them. While an experienced CPA has the know-how to wade through mountains of transactions, the process may prove too time-consuming for you.

Opening a separate business account is the best piece of advice I can give any business owner interested in doing their own business accounting. Doing so can save you unnecessary headaches during tax season.

Are you familiar with business-related tax deductions?

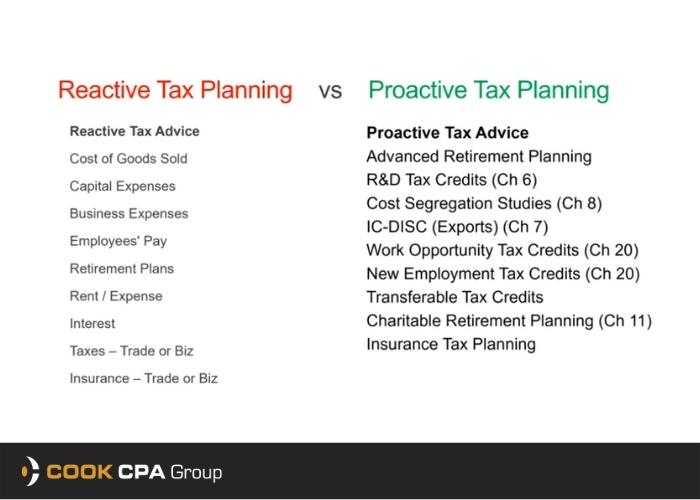

One of the main arguments against doing your own business accounting is missing out on business-related tax deductions. With the potential to save hundreds if not thousands of dollars on your tax bill with business-related deductions, you must know the opportunities you can take to pay less in taxes.

Business deductions are an important component of any tax filing, and accurate accounting plays a major role in claiming the appropriate tax savings. No matter the size or years in business, every business can and should leverage deductions. But researching eligibility requirements and ensuring you can legally claim the deduction can become a complex process.

Many people who opt to do their own business accounting also prefer to file their own taxes. While this can streamline the tax filing process, you could potentially be leaving money on the table. We strongly recommend you consult with a trusted CPA for guidance.

Cook CPA Group has decades of business accounting experience. We encourage you to schedule a free consultation with us if you’re debating whether to do your own business accounting. We can guide you through the important steps you should consider and serve as a resource for any business accounting questions you may have.